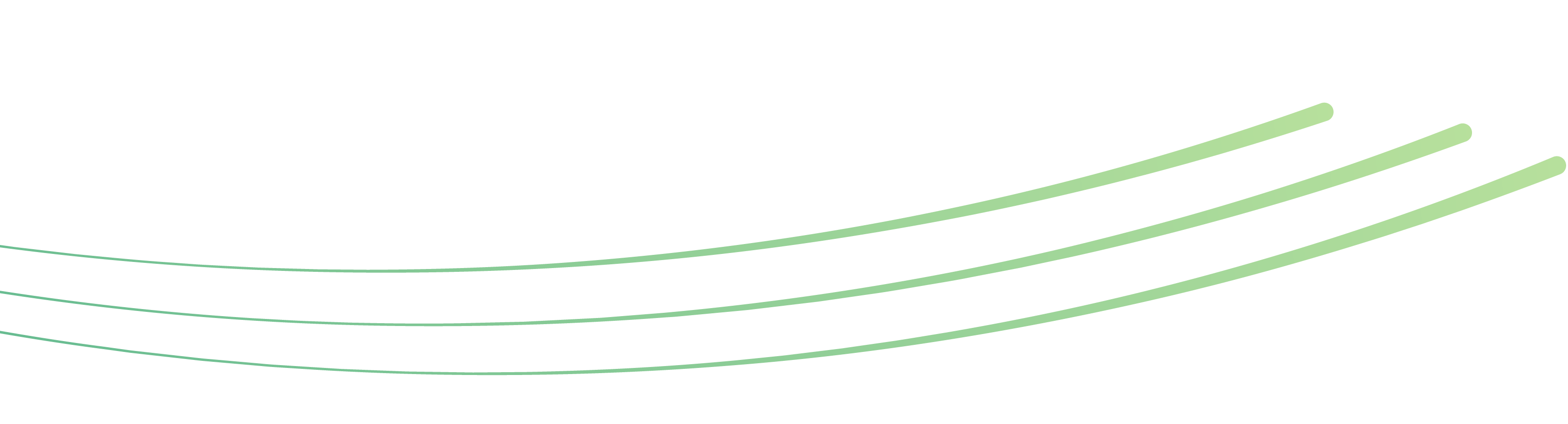

Our Risk Management Process

To accomplish the Company’s strategic goals, First Gen identifies and analyzes risks and opportunities in value creation and develops and implements action plans to address these risks. We involve important stakeholders from business divisions, project teams, and support groups to ensure that these risks are included in their risk registers. Along with the Enterprise Risk Management (ERM) group, these various groups conduct risk analyses based on the likelihood, impact, and determination of risk ownership, as risk owners are involved in creating mitigating measures. In addition, the Company monitors these risks through frequent updates, conversations with Senior Management, and presentations to the Board Risk Oversight Committee (BROC) to ensure the effectiveness of the risk management process and attendant mitigating measures.

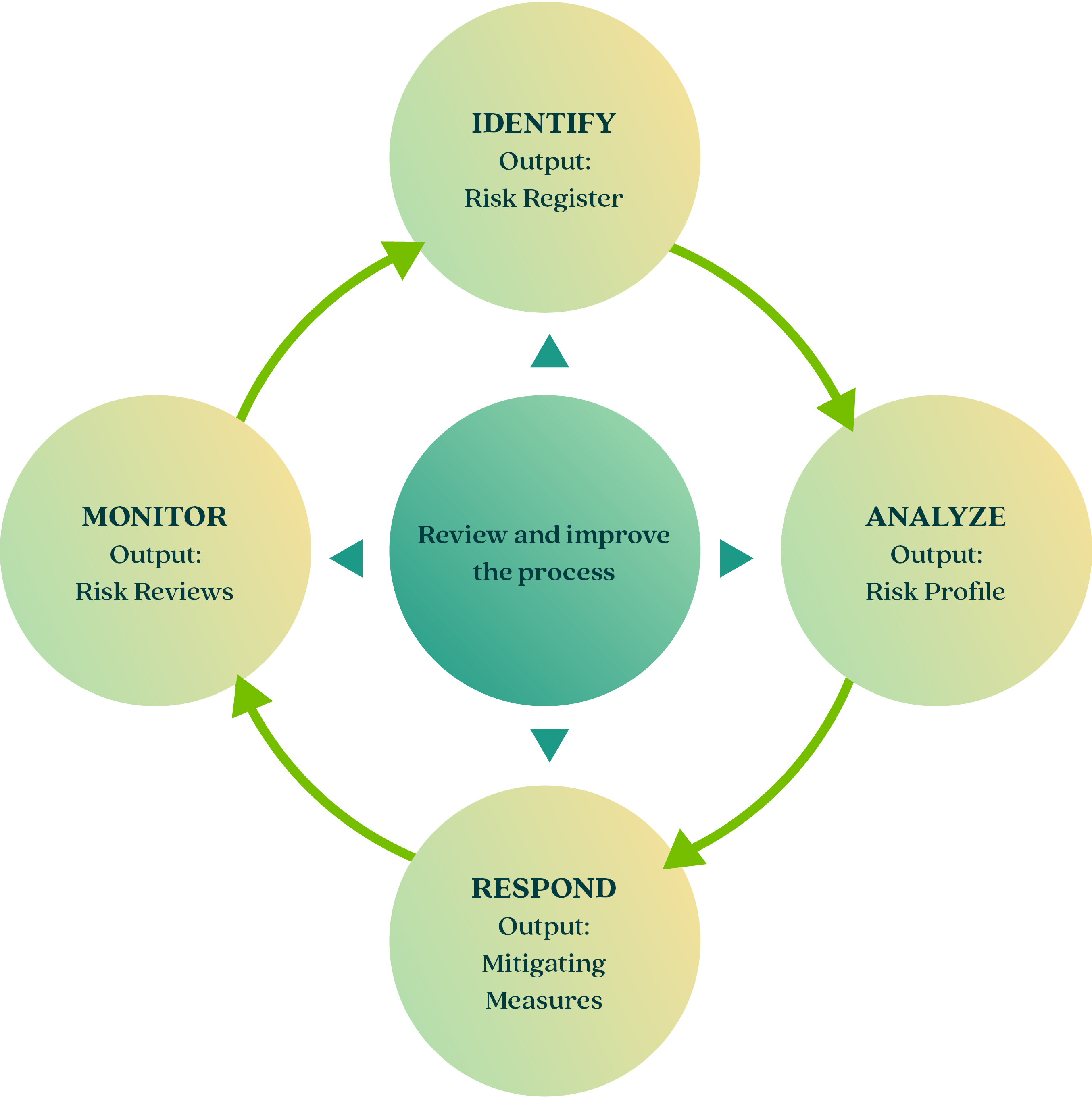

We Manage Risks in Four Levels

Our Risks Mitigating Measures

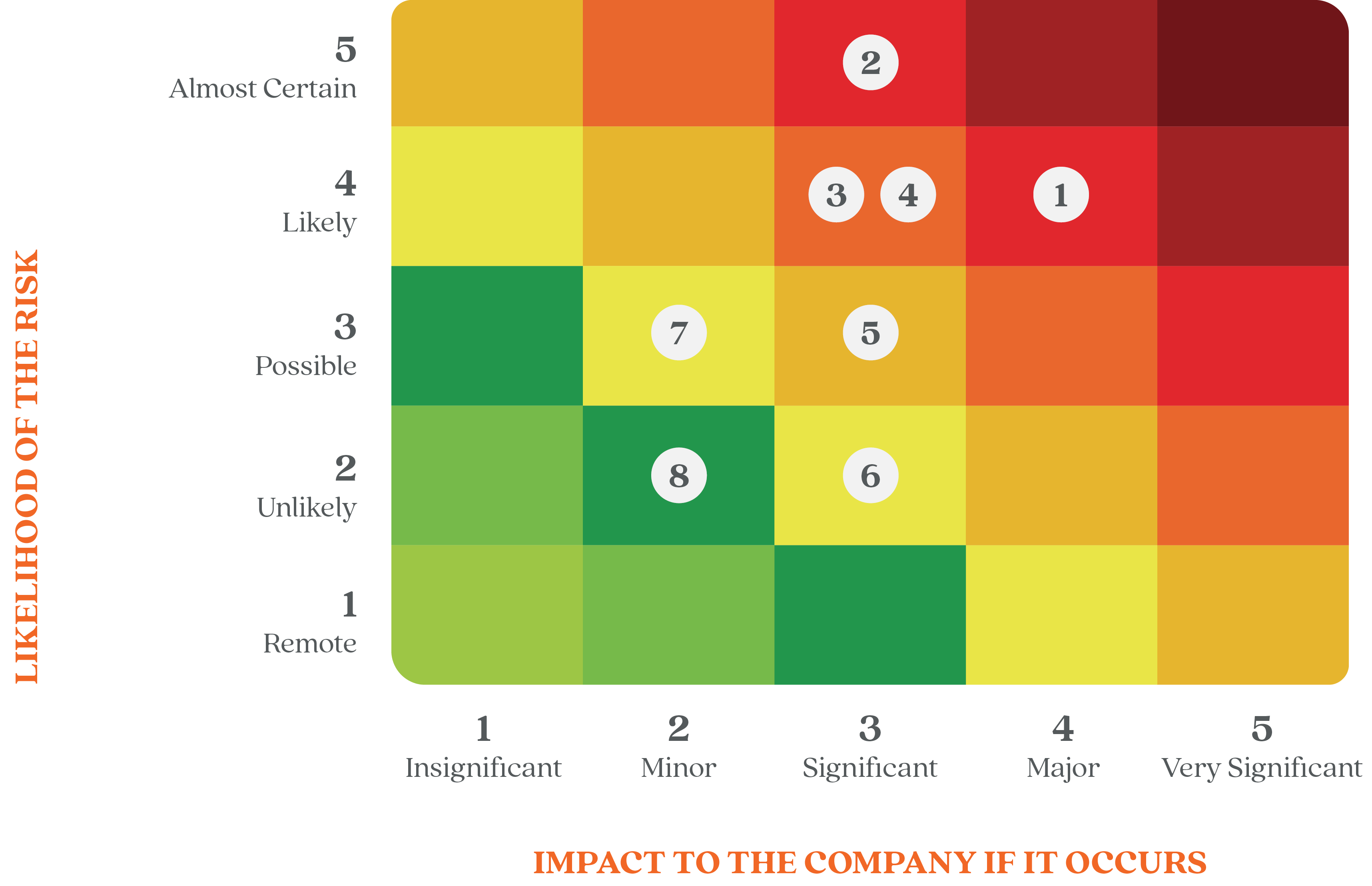

First Gen carries out a thorough risk management procedure which includes all active projects, operating facilities, and support units. Based on the ratings, this procedure identifies the important risks and develops the suitable mitigation solutions. Regular presentations on the top risks are presented to Senior Management and the BROC:

| External Risks & their Direct Effects | Mitigating Measures | |

|---|---|---|

|

1 - Market Risk

|

The Company has:

|

Risk time horizon*: Short to Long term Stakeholders directly affected: Capitals affected by the risk: Likelihood: Possible |

|

2 - Political and Regulatory Risks

|

The Company has:

|

Risk time horizon*: Short to Long term Stakeholders directly affected: Capitals affected by the risk: Likelihood: Likely |

|

3 - Climate Risk and Exposure to Natural Catastrophes

|

The Company has:

|

Risk time horizon*: Short to Long term Stakeholders directly affected: Capitals affected by the risk: Likelihood: Almost Certain |

|

4 - Fuel Supply Risk The depletion of the Malampaya gas field and our steam supply challenges may affect our production and cash flow. Operations are highly dependent on:

The invasion of Ukraine by Russia in early 2022 also increased our exposure to the supply disruption and price shocks of key commodities, including oil and natural gas. |

Natural Gas Plants The Company has:

Geothermal Plants The Company has:

|

Risk time horizon*: Short to Medium term Stakeholders directly affected: Capitals affected by the risk: Likelihood: Likely |

|

5 - Competition & Technology Risk

|

The Company has:

|

Risk time horizon*: Short to Medium term Stakeholders directly affected: Capitals affected by the risk: Likelihood: LIkely |

|

6 - Cybersecurity Risk The modernization and interconnection of our assets and Information Technology (IT) infrastructure increased our operation efficiency, but also exposed us to cyber security risks. |

The Company has:

|

Risk time horizon*: Short to Long term Stakeholders directly affected: Capitals affected by the risk: Likelihood: Possible |

|

7 - Financial Risks

|

The Company has:

|

Risk time horizon*: Short to Long term Stakeholders directly affected: Capitals affected by the risk: Likelihood: Possible |

|

8 - Pandemic Risk The ongoing COVID-19 pandemic affects the Company’s operations, workforce, customers, market, and earnings. It may impact our revenue generation, cash flow, and delay our growth projects. |

The Company has:

The comprehensive responses on pandemic risk are discussed under Human Capital Performance and Social and Relationship Capital Performance. |

Risk time horizon*: Short to Medium term Stakeholders directly affected: Capitals affected by the risk: Likelihood: Unlikely |

Our Opportunities

To respond to the changing energy market and external trends, First Gen continuously evaluates the conceivable opportunities that support value generation and seized the opportunities consistent with our mission, purpose, strategy, and capabilities.

First Gen used a number of procedures, such as the Strategies and Synergies Planning (SSP), Business Unit (BU) Planning Sessions, and various research initiatives, such as those of the Engineering Services Department (ESD) and Business Units, to identify key opportunities and direct strategy and planning.

The proceeding table outlines the opportunities and significant trends, surrounding context, strategies, relevant capitals, stakeholder impacts, and benefits to the organization in the short, medium, and long terms. These were identified and analyzed by the Execom, Senior Management, and secretariat staff by facilitating the numerous presentations and creating research and materials through the SSP process.

The Philippine ambition to pursue the clean energy transition is led by Renewable Energy and Natural Gas

| Opportunity Context:

The DOE’s Philippine Energy Plan (PEP 2040) highlights the country’s ambition to significantly increase Renewable Energy (RE) and Gas, while decreasing dependence on coal. Pursuing this ambition emphasizes the need for further development of RE options and natural gas plants. Aside from highlighting the opportunity to build new power plants, this recognizes the role of natural gas as a crucial complement to enabling renewable energy. As such, there is a larger directive towards a more complementary fuel mix led by gas and renewables. This ambition is supported by government programs that aim to increase the opportunities for developing RE and clean energy systems. |

Contributing Capitals:

|

Impact to Stakeholders:

|

Organizational Benefits:

This will create long-term benefits as it encourages financial support and public demand for our clean energy and natural gas projects. |

| Working Strategy:

First Gen continues to operate among the biggest RE capacity in the Philippines and has the largest natural gas capacity–all while staying true to the zero coal stance it has taken since 2016. As such, the Company aims to be a leader in the clean energy transition–a viewpoint consistent with the country’s ambition towards a cleaner and more resilient fuel mix. By leveraging our diverse and complementary portfolio, First Gen will take a portfolio approach in marketing and developing its assets. Our investment in the LNG Terminal, for instance, helps actualize this ambition by enabling us to expand our gas capacity and increase our ability to support RE investment. |

Increasing interest in decarbonized and regenerative business models

| Opportunity Context:

Global and local financing and commercial institutions have increasingly focused on sustainability. An example is the BSP’s launch of the Sustainable Investment Framework, as well as other sustainability frameworks from various financial and commercial institutions. This support is only rising as the public awareness about sustainability grows. Based on Pulse Asia’s latest survey on renewable energy, 89% of the 1800 nationwide respondents are in favor of increased RE use. In line with this, industries worldwide are increasingly targeting to decarbonize their supply chains. Interest in decarbonization has influenced the development of decarbonized technologies, such as electrification (i.e. EV’s), energy efficiency, carbon capture, and hydrogen. |

Contributing Capitals:

|

Impact to Stakeholders:

|

Organizational Benefits:

In the long-term, the Company will benefit through increased access to the burgeoning retail market. Emerging regenerative business can also contribute to decarbonizing our assets and business models. |

| Working Strategy:

First Gen can leverage this interest by working with regenerative partners who will support the clean energy transition. This will help us secure markets and pathways towards our shared regenerative future. In line with this, First Gen continues to monitor the development of key technologies that support our decarbonization journey, as well as those of our partners. |

Development & preparation for new/emerging electricity markets

| Opportunity Context:

With the Retail Customer and Open Access (RCOA) and Green Energy Option Program (GEOP), new markets have emerged. These markets provide end-users with energy source options. RCOA also continues to progress with dropping thresholds, ultimately driving towards household eligibility. |

Contributing Capitals:

|

Impact to Stakeholders:

|

Organizational Benefits:

RCOA and GEOP will create short to long term benefits because of increased markets for our RE Portfolio. RCOA will revolutionize the industry towards increased customer centricity and more democratized power markets. |

| Working Strategy:

First Gen is developing retail capabilities and holistic service capabilities to cater to the needs of the retail market. |

National need for additional clean energy supply to support growth

| Opportunity Context:

As economic activity grows, the Philippines will increasingly require new power capacity. This need must be filled by clean energy capacity, given the decreased interest in coal and regulations such as the coal moratorium. As such, the growing economic demand creates the need for new clean energy supply–a key opportunity for power plant developers. The aforementioned PEP 2040 highlights the need for growth, while adding that the additional capacity is expected to come primarily from renewable energy and natural gas. This need for additional clean and renewable energy capacity must be served–which creates an opportunity for power generators. |

Contributing Capitals:

|

Impact to Stakeholders:

|

Organizational Benefits:

The need for more energy is only increasing. This increases the value of both our existing and potential growth power plant assets, by ensuring that there is enough demand for our continued growth in the industry. As such, this opportunity creates a significant pathway for growth– especially for a clean and renewable energy company such as First Gen. |

| Working Strategy:

In line with this opportunity, First Gen is pursuing significant growth. As the company grows, First Gen will also aim to continue to diversify its portfolio by increasing the proportion of natural gas–while also continuing to grow natural gas. growing only via natural gas and renewables, without investing in coal. As we grow, we will continue pursuing initiatives that improve the resilience of our asset operations and ensure the reliability of our power generation. |

These opportunities will assist in further decarbonizing First Gen’s portfolio and streamlining processes, and potentially create new revenue streams consistent with our vision and goals, generate new projects, develop new markets for asset expansion, and ultimately support national energy security. First Gen continues to advance in our strategies and operations as we endeavor to preserve our current portfolio and develop new opportunities.