Key Theme:

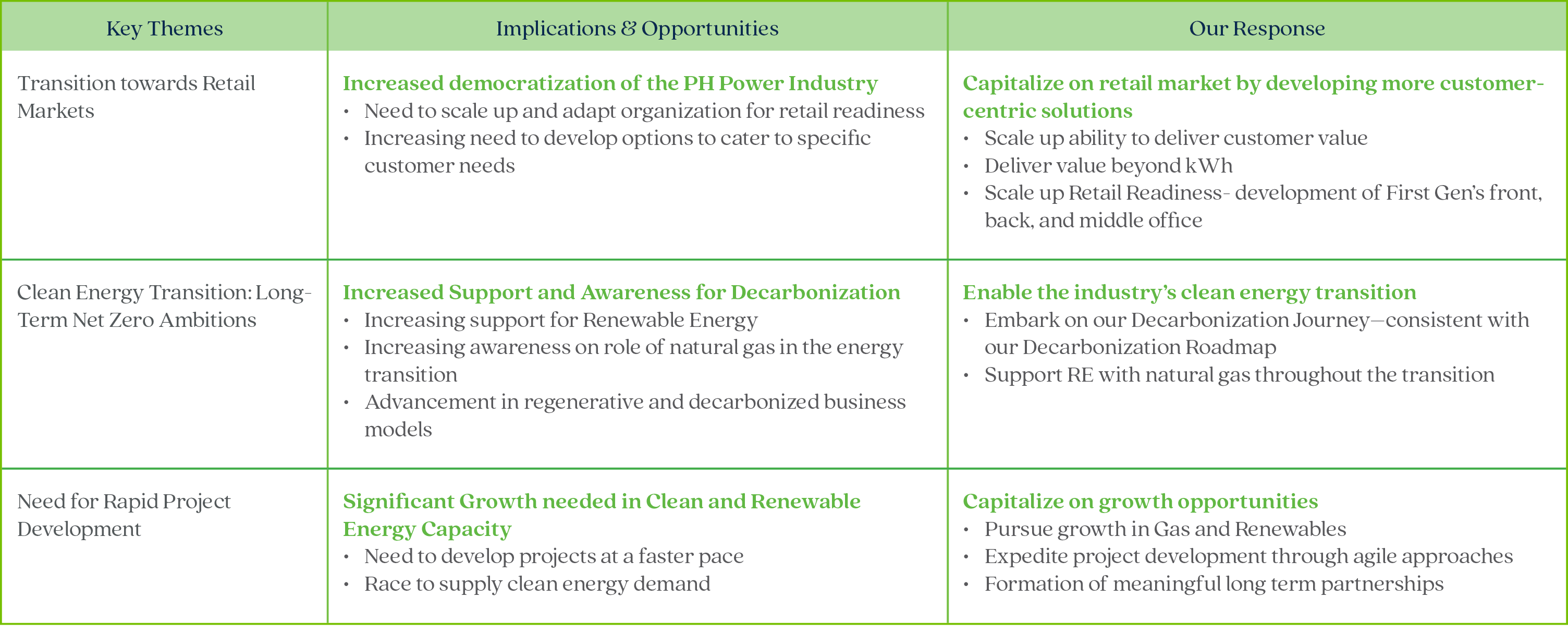

Transition Towards Retail Markets

Context

The power sector previously focused on a smaller number of large and regulated customers. Historically, end consumers could only contract with Distribution Utilities or Energy Co- Operatives (Co-Ops) in terms of procuring electricity. However, with the advent of RCOA, the industry has shifted towards a more fragmented market of smaller and more diverse customers. RCOA provides customers that are within a certain size threshold the ability to contract directly with power generation companies via Retail Electricity Suppliers (“RES”). As such, power companies are now able to directly contract with customers who are able to reach this threshold–or “Contestable Customers”.

Thresholds for RCOA are set to decrease moving forward, which means that smaller customers will be able to directly contract power. This gives more and more customers the ability to procure electricity in a more retail manner, and enables the market to transition towards increased customer-centricity. Ultimately, thresholds are targeted to lower towards a level where individual households can be considered “Contestable”—essentially transforming the industry into a retail, consumer-focused market.

Opportunities

As with the rest of the industry, this change prompts us to evolve our organization, infrastructure, and ability to meet customer needs and expectations effectively. This significant market change means an expanded opportunity to market electricity in a more nuanced and customer-focused manner.

The transition towards retail markets also provides the customer with more choice and enables more ways of serving specific customer needs and requirements. Furthermore, it provides opportunities for clean energy players, as like-minded customers who qualify for retail access will be able to choose cleaner energy solutions. As retail thresholds drop, the market will increasingly become more liberalized.

Such a transition will definitely require an evolution in how power is marketed. However, organizations that are able to cater to these new market demands will be able to capitalize on new opportunities that these changes can bring.

Our Response

In response to this retail opportunity, First Gen has significantly improved its marketing and retail capabilities by developing front, back, and middle offices to cater to customer needs better. Moreover, it has progressed in developing additional services to provide value to our customers beyond Kwh sales– in an effort to capitalize on opportunities from increased customer centrism.

Moving forward, First Gen intends to accelerate the scaling up of current retail capabilities during this market transition to address a growing customer base with more distinct needs. As the market becomes more customer-centric, our ambition is to become a holistic clean energy solutions provider that can cater to the specific needs of our customers.

Key Theme:

Clean Energy Transition - Long-Term Net Zero Ambitions

Context

Since the Paris Agreement, there has been a larger focus on the need to address Climate Change on a global scale. Countries and companies around the globe have increasingly committed to make their way towards a Net Zero future. As part of these commitments, various organizations are looking towards greening their supply chain and transitioning their business processes towards more sustainable and decarbonized practices. Perhaps more than ever before, there is a call for businesses to be mindful of their impact on the environment–a trend that will likely only accelerate as the urgency of climate action increases.

As mentioned in the External Environment, businesses are also becoming increasingly aware of Scope 3 Emissions, as companies globally are looking to green their respective supply chains. As the call for climate action becomes more urgent, we believe that industry’s demand for greener supply chains will rapidly ramp up, as well. As such the call for greener ways of doing business–which translates to cleaner sources of energy–will be a prevailing industry theme for the long run.

Aside from sentiment increasingly favoring net zero, technology advancements will also enable the viability of a net zero future. Improvements in the economics of clean energy sources, as well as development in decarbonization technologies like Hydrogen and Carbon Capture can enable the long-term transition to Net-Zero.

As such, we see that this call towards Net Zero will continue to be a significant trend that will define the future of not only the power industry, but every other industry, as well. The future of the energy industry will be defined by a transition towards clean and renewable energy solutions.

Opportunities

The road to a Net-Zero will inevitably pass through cleaner energy options–especially given the crucial role that clean energy plays in reducing Scope 3 emissions for various businesses. As such, this trend creates significant opportunities for clean energy players like First Gen–as the value of a clean power portfolio increasingly becomes recognized. Combined with the increased viability of low carbon power sources, this market context is a key enabler for the clean energy solutions that First Gen provides.

The increased focus on sustainability is more than just a trend, as it is becoming a necessity across industries. We believe the increased awareness on the value of sustainable business practices and models will help enable the upheaval needed towards better ways of doing business. As industries pursue sustainability, they create more opportunity for First Gen to deliver on our Mission of Forging Collaborative Pathways for a Decarbonized and Regenerative future.

Our Response

The First Gen Portfolio is extremely well positioned for the Clean Energy Transition. This trend portrays a significantly positive outlook for the company. One of First Gen’s core defining principles is our commitment to maintaining a clean and zero-coal portfolio. Our early transition from coal gave us a substantial lead in the clean energy sector, most notably in natural gas and geothermal power generation. With the increasing transition towards clean energy, we have not only yielded substantial returns on investment, but also developed a diverse portfolio to help progress towards a more decarbonized and regenerative power industry. Our portfolio of natural gas and renewables is set to provide the country’s clean energy requirements. As such, we respond to these opportunities by ensuring the resilience of our current portfolio and pursuing growth in our clean energy capacity.

The future will be largely defined by a pronounced clean energy transition and increased demand for clean energy options. This transition will require more dependence on renewables, but will also be predicated on enabling technologies, such as the Liquefied Natural Gas Terminal, to provide the needed reliable support for intermittent renewable energy. As such, First Gen aims to facilitate the clean energy transition by developing and growing its clean energy portfolio, consisting of renewables and natural gas to support the energy transition. Through our diverse and complementary portfolio, we aim to ensure energy security as we make the crucial transition to a lower carbon energy future.

Our portfolio of gas and renewable assets already provide the grid with lower carbon options compared to alternatives like coal. While we already have a low carbon portfolio, we have taken several steps to keep abreast, and eventually adapt technologies to decarbonize our portfolio, as they become viable. Ultimately, we aim to elevate the transition towards clean energy by understanding, localizing, and scaling clean energy emerging technologies and business models, while expanding our portfolio of natural gas and renewable energy assets. Moreover, technologies such as Carbon Capture and Hydrogen, while nascent, can further decarbonize our energy portfolio moving forward. These technological advancements are supplemented by developments in our intellectual capital, namely our efforts to understand decarbonized business models as we also continuously scale our decarbonization efforts.

While this transition will take time, future developments are supportive of a cleaner energy future, as advancements in technological capacity support the increased viability of clean energy sources. This suggests promising growth in financial, intellectual, and operational capitals coming from clean energy investments. Globally, various renewable and sustainable energy sources have increasingly become crucial, especially with the decreased capital costs of solar and wind power development. This not only increases the economic feasibility of future capital ventures, but also allows us to maintain our commitment to a zero-coal energy portfolio and serve our growing consumer base.

Key Theme:

Need for Rapid Project Development

Context

As discussed in the External Environment section, the DOE has recently released its Philippine Energy Plan (PEP), which exhibits the country’s long-term energy plan up to 2040. In line with the country’s growing economic activity, this plan projects significant growth in the country’s power capacity–increasing by almost two times by 2030 and almost five times by 2040, according to their Clean Energy Scenario (CES). Moreover, this growth will be driven primarily by Natural Gas and Renewable Energy. Consistent with the country’s transition towards a much cleaner energy mix, coal capacity is expected to stagnate, while natural gas and renewables will experience massive capacity increases. In short, this PEP presents an outlook that anticipates an increasingly renewable future.

Guided by this, we foresee an industry that will be growing rapidly, particularly in the fields of Natural Gas and Renewable Energy. For such growth to occur, power projects must be completed in rapid succession, as well. The significant need for additional power capacity, as well as the changing market conditions, creates opportunities for project developers that are able to provide the needed growth.

Historically, project development in the power sector focused on executing a few large projects at a time. However, recent industry experience has moved towards rapid project development including smaller projects, in response to growing energy demand and innovation. The advancement of technology–including distributed energy systems, RE developments, and smaller fast- ramping units–has created additional options to cater to the grid’s requirements in a more flexible manner. Moreover, there has been significant evolution in project management principles that have enabled more rapid and nimble execution. As the industry continues to evolve, opportunities for growth will also come more rapidly.

Opportunities

The increased pace in project development enables proponents to fulfill the increased need for power supply. Furthermore, the evolution in the project development also comes with advancements in technology and intellectual capital, which can benefit organizations that are able to adapt them. Moreover, the rapid industry development is enabled by new ways of doing business that can benefit companies that are agile enough to adapt and utilize them. These industry advancements are crucial enablers to growth, allowing proponents to develop at a pace that aims to match the growth in power demand.

Moreover, the rapid development in the industry also signifies how critical it is to maintain the resilience of our assets. As the grid requires more projects to fulfill its needs, it will also require existing assets to continue operating dependably, as well. In short, the expected growth in clean energy creates a significant opportunity for power generators who aim to progress the country’s clean energy transition.

Our Response

To address these opportunities, First Gen is currently scaling its ability to build multiple projects simultaneously. Adapting to a more rapid industry pace, we aim to adopt more nimble project development strategies that will allow us to execute across multiple fronts. In line with this, the company continuously evolves our project development approach, and keeps our organization up to date with regards to technologies and methodologies that enable a more nimble approach to project development. This industry outlook is supportive of the company’s current portfolio and future prospects. As such, we see the opportunity to expand our portfolio while also ensuring the resilience of our assets.

First Gen aims to develop assets in line with key market and industry trends, adopting agile principles to ensure quality even as projects are developed more rapidly. We keenly stay abreast of potential innovation, closely tracking both established and emerging technologies that can allow us to serve power requirements in a more flexible and efficient manner. We also continue to monitor various technologies that enable nimble execution, including smaller scale power plants, decentralized energy projects, and various renewable energy systems that can more rapidly respond to industry opportunities.

Moreover, First Gen continues to prioritize the resilience of its various assets to address both predictable and fortuitous events. As the industry continues to transition, we also continue to strive for excellence and reliability with regards to our asset management.