Financial Capital Management

Financial capital consists of operational funds that are managed to achieve the best possible economic and social outcomes that can increase stakeholder value. We prioritize stakeholder interests and ensure the efficient use of resources.

We utilize financial models to determine the cash and income generated by our subsidiaries and the Company as a whole, and to evaluate potential returns on new projects against the Company’s hurdle rates. The company negotiates with lenders to secure debt with favorable terms tailored to our needs, while meeting leverage ratios and debt service coverage ratios to ensure our ability to meet debt obligations.

We are committed to maximizing shareholder value by optimizing the use of our financial capital. We pay dividends while also strategically allocating cash for debt payments and growth projects that can sustainably increase company value.

Investor Relations

At First Gen, maintaining investor trust and transparency is a top priority. The Investor Relations team is responsible for communicating the Company’s message, strategy, and objectives to all financial stakeholders, while also ensuring timely updates and providing a platform for concerns. Building trust and aligning ESG initiatives with stakeholders’ goals are also key objectives.

The team holds meetings with existing and potential shareholders regularly and responds to inquiries promptly. It also issues press releases, announcements, and public disclosures to keep stakeholders informed. Feedback from stakeholders is reported to Senior Management.

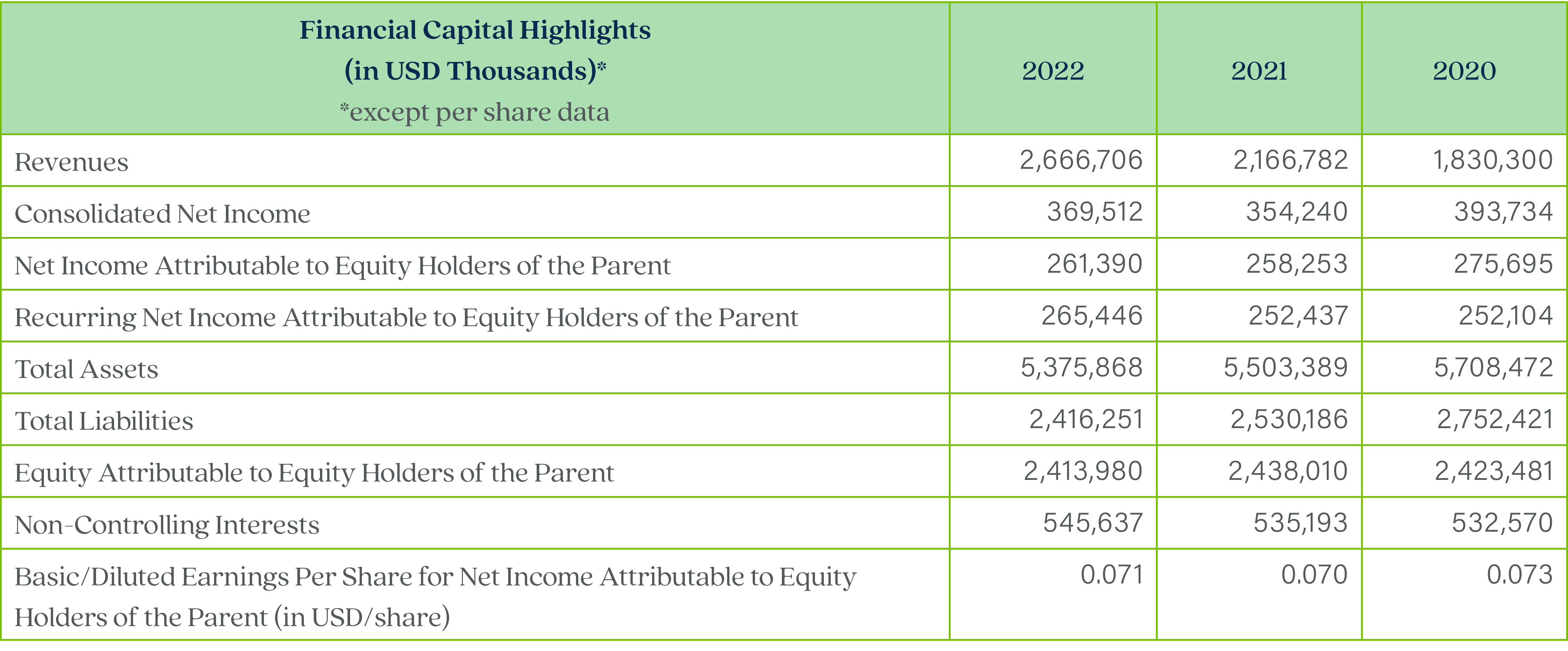

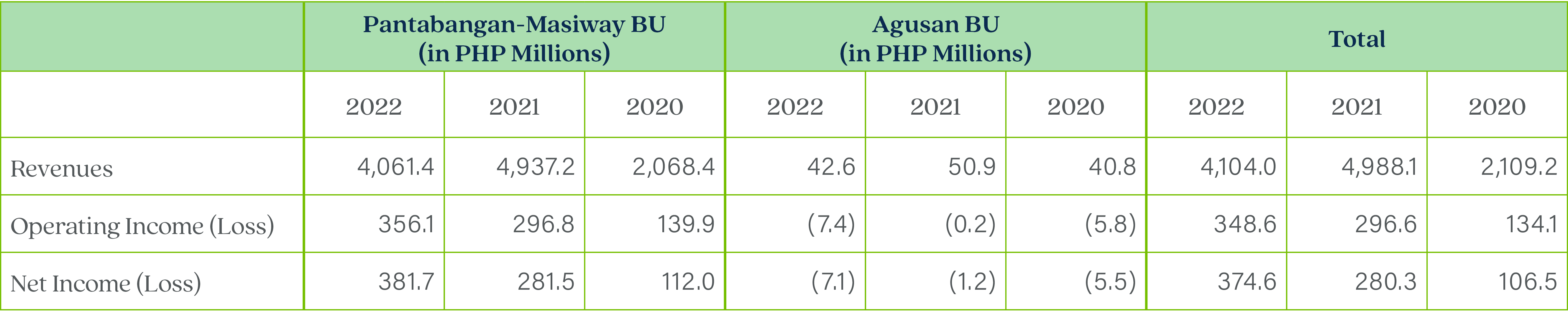

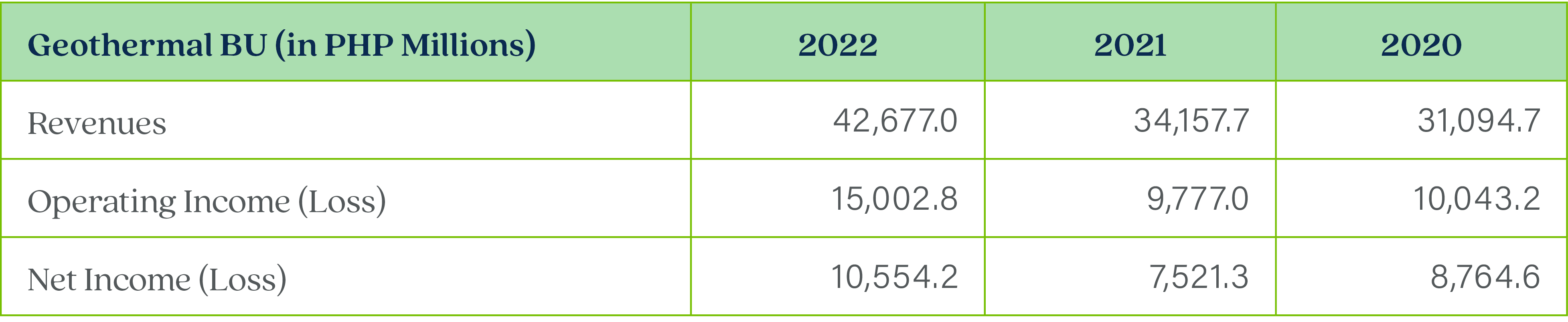

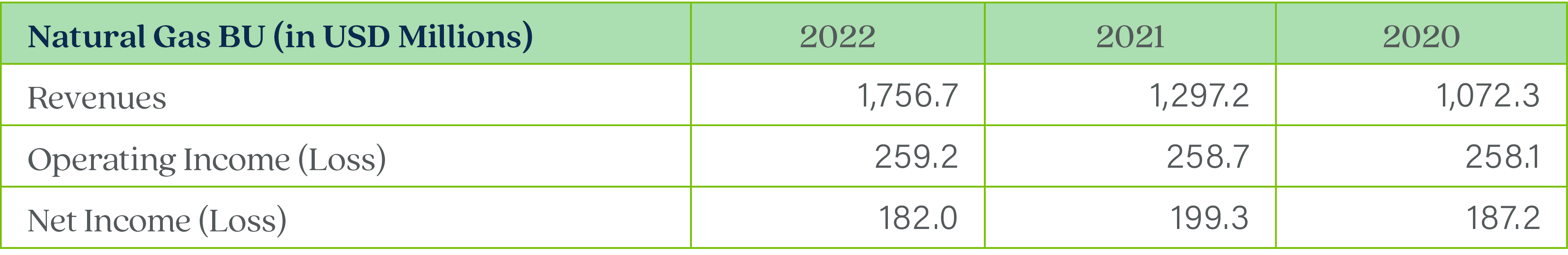

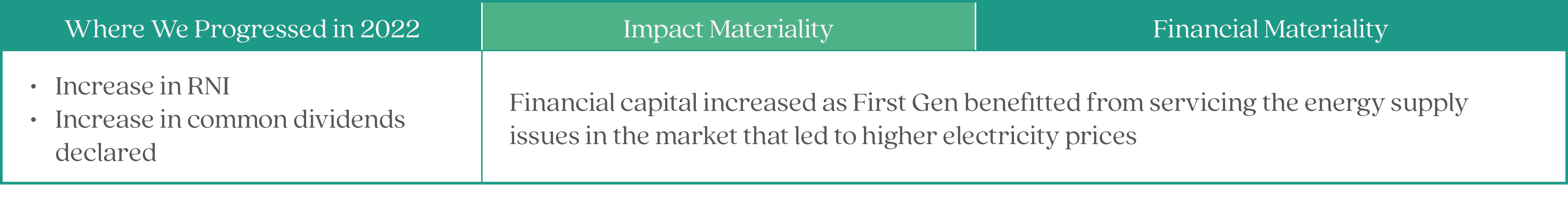

Financial Highlights & Capital Usage

At First Gen, maintaining investor trust and transparency is a top priority. The Investor Relations team is responsible for communicating the Company’s message, strategy, and objectives to all financial stakeholders, while also ensuring timely updates and providing a platform for concerns. Building trust and aligning ESG initiatives with stakeholders’ goals are also key objectives.

The team holds meetings with existing and potential shareholders regularly and responds to inquiries promptly. It also issues press releases, announcements, and public disclosures to keep stakeholders informed. Feedback from stakeholders is reported to Senior Management.

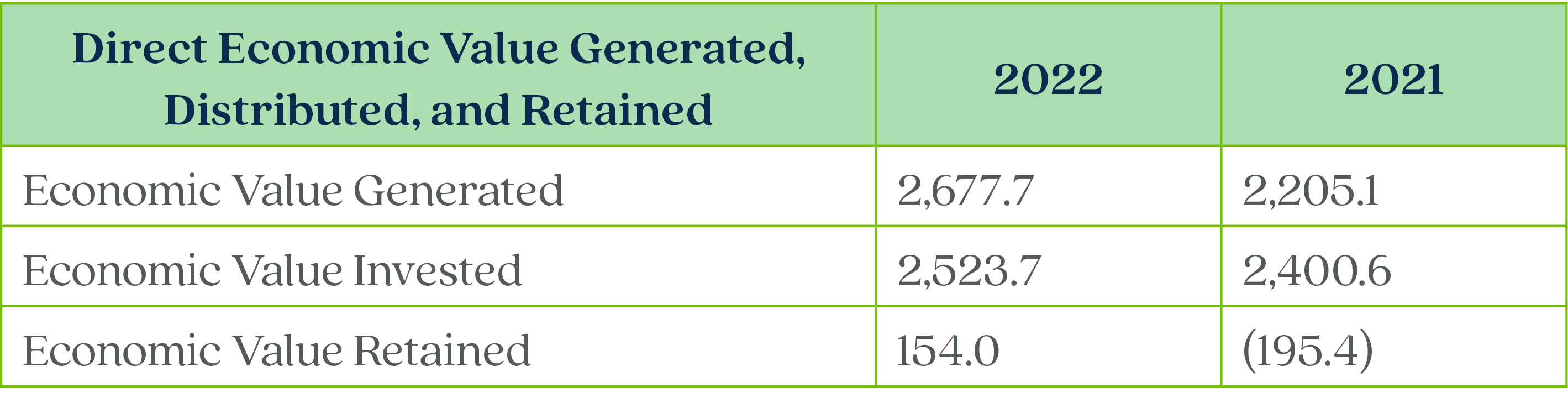

Financial Capital Distribution (in USD Millions)

In 2022, 94% of First Gen’s total generated economic value was invested into the economy in the form of operating costs, employee wages and benefits, payments to providers of capital, payments to the Government, and investments in the community by implementing health, education, livelihood, environment, emergency response and relief, and socio-cultural programs.

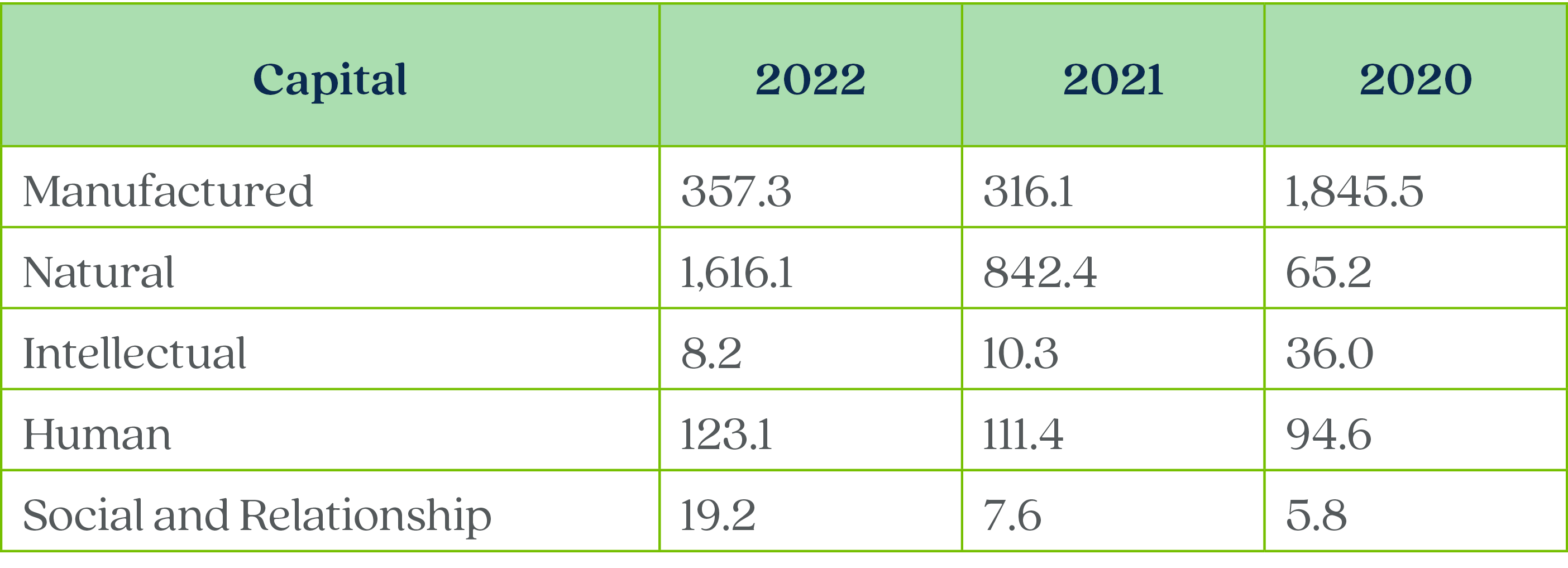

First Gen increased its investments in natural capital, manufactured capital, human capital and social and relationship capital in 2022.

We directed investment efforts towards natural capital, which represents 76.1% of operational expenses and investments, to secure power supply in the grid. This was accomplished through land procurement and upkeep, obtaining permits, complying with environmental regulations, implementing corporate social responsibility (CSR) projects and initiatives, enhancing resource efficiency, and implementing water and waste management practices.

In addition, we invested 16.8% of operational costs and investments in manufactured capital. This was used for constructing the LNG Interim Offshore Terminal (IOT) Project to address the depletion of the Malampaya gas field, building the Palayan Bayan, Mindanao 3, and Tanawon geothermal plants, procuring and installing new equipment, operating and maintaining power plants, improving buildings towards resiliency, and enhancing shelter-in-place programs. EDC inaugurated the 3.6-MW Mindanao 3 binary plant on April 27, 2022, while the LNG IOT is set to be completed in 2023 to ensure grid security.

First Gen prioritizes its employees, allocating 5.8% of total operational costs and investments for their welfare. The company provides occupational health and safety training, medical and psychosocial programs, and invested in the procurement of COVID-19 vaccines in 2021. Additionally, the company invests in the growth of its employees by providing skills development, training programs, and subscriptions to learning platforms like Udemy.

First Gen also invests 0.9% of its total operational costs and investments in social and relationship capital to strengthen its relationships with local communities and other stakeholders. The company adheres to community and LGU regulations, conducts CSR activities, donates to social causes, networks with associations, sponsors events, and pays membership fees.

Lastly, the remaining 0.4% is invested in intellectual capital, which includes IT software and tools, branding and marketing, cybersecurity measures, research and studies, and securing ISO certifications.